Colliers Report: 2019 Flexible Workspace Outlook

Colliers International Group, a massive global real estate and investment management company, just released a very detailed report on the present and future of the flexible workspace industry.

The report will be combined with subsequent studies on markets in Europe, the Middle East, Asia, and Latin America. Colliers looks at trends for both operators and investors, and forecasts for anyone involved with flexible office space and Coworking.

Here are some of the major takeaways from the report:

- There appears to be no slowing down the growth of flex office space right now. The industry accounts for one-third of office leasing the last 18 months.

- Last year, the number of Coworking spaces in the U.S rose 16%, and an incredible 36% internationally. This pace is expected to slow, but still remain strong in the next 5 years.

- As a whole, flexible workspace encompasses 1.6% of all the inventory in the study’s 19 markets.

- There is a direct correlation between Coworking popularity and high-wage, tech markets. Concentration of Coworking spaces in these markets is nearly double the other studied markets.

- WeWork maintains a massive lead in terms of total square footage leased. However, Regus is far and away the leader in total number of sites.

- In the 19 studied markets, the top 10 operators control nearly 4 times more space than all other operators combined, and nearly double the sites.

- While the industry has never been tested in an economic downturn, it could be in position to withstand a recession. Operators could benefit if tenants rely more on short term leases and flexibility in a time of crisis.

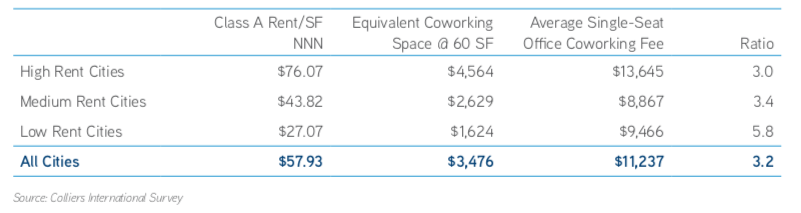

- The chart below shows the disparity between the average rent costs for class A space, and the equivalent for 60 sq ft of Coworking space (the typical space per member in a Coworking space)

These are just a few of the great finds in the report. To download the free study in its entirety, click the link below. To learn more about how Yardi Kube is the platform of choice to power successful Coworking spaces, please click here.