A recent report posted by BMO Capital Markets revealed that while WeWork has significant value and its value is increasing, it ‘increasingly poses a competitive threat to office owners’.

WeWork recently held a presentation at headquarters in NYC, and based off the information they shared, BMO put together an extensive report with the key points and their takeaways. To download the free full report, click the link at the bottom of this article. Here we present some of the biggest takeaways from the report.

WeWork categorizes 63% of NYC companies as small businesses, and an enormous 20% of NYC entrepreneurs are WeWork members.

Per the BMO report, there were also much less quantifiable data shared in the presentation, such as WeWork claiming to have a positive impact on local retail and multifamily. Hard to prove that with numbers, but nonetheless, that was their claim.

WeWork’s stance is that values on assets sold have increased 50-120% shortly after it moved in. While this has some generalizations to it, BMO notes that this could be a company striving to have its cake and eat it too. High valuation, light asset growth model, combined with profit participation and more favorable debt terms.

Real Estate Impact

WeWork is quickly becoming a force in the commercial real estate sector. They formed WeWork Property Investors with JV partner Rhone Group, raising an estimated $400M to invest in the real estate it occupies.

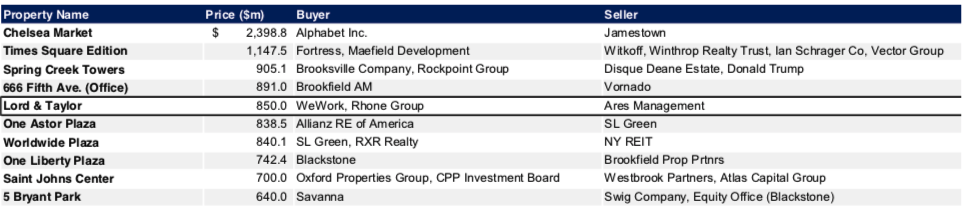

But the bigger news was made when they acquired Lord & Taylor’s flagship Manhattan location for $850M in late 2017. Of the 675,000 square feet, they then subleased 150K back to Lord & Taylor. The rest will become WeWork headquarters. This was the 5th largest transaction in NYC in the last calendar year. That’s a remarkable stat considering the traditional powerhouses that rank right around them, Trump, SL Green, NY REIT, Jamestown, among others.

Boston Properties EVP John Powers was on a panel as part of this presentation and he believes Coworking could become 2-5% of the office market, but probably not up to 10% as some have predicted.

WeWork’s impact on local communities is evident in job creation. Per their presentation, 19% of new jobs in Long Island from 2015-18 are located in a WeWork. There has been a 9% increase in occupancy in Crystal City, to which the company takes credit as a ‘major driver’.

Corporate Coworking

Enterprise clients continue to grow as a larger sector of the Coworking market. In November 2016, Microsoft signed up 70% of their NYC sales team (nearly 300 employees) for WeWork memberships. They also designated a 37 person team in Atlanta to begin working out of a WeWork location.

The total revenue from corporate clients exceeded $250M in 2017, basically a quarter of WeWork’s total $1B revenue last year. This is a segment of the market that is no longer just a trend, its beginning to be one of the driving forces behind the Coworking revolution.

Although it is very popular, BMO’s report states that this is one aspect of WeWork’s success that landlords view as ‘addressable competition’. Silverstein Properties already offers a competitor, Silver Suites. And Boston Properties has stated it will enter the field as well in one of its Chelsea buildings.

BMO’s report is thorough and encompasses several aspects of WeWork’s data with interpretations of their own. To read the full report, click this link.

To learn more about how the Yardi Kube platform can efficiently power your Coworking or shared space, click the button below.