5 Key Takeaways from the Coworking Industry Report: Q2 2024

The U.S. coworking industry is evolving rapidly due to the rising demand for flexible work environments. As more professionals seek dynamic and collaborative spaces, coworking operators adapt to meet these diverse needs, enhancing productivity, creativity and community among workers from various industries.

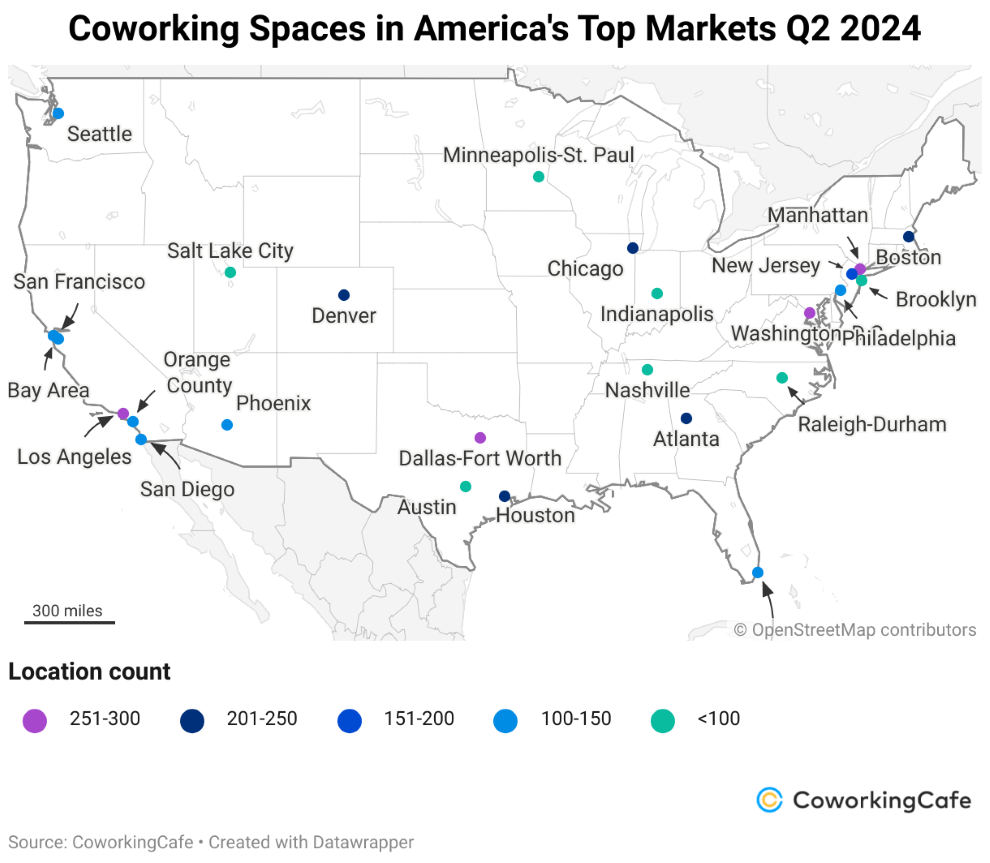

To monitor this evolution, CoworkingCafe analysts monitored the coworking sector’s growth and changes in real-time. The coworking industry report examines coworking space inventory, recent prices, total and average square footage and leading operators in the top 25 U.S. markets, following the Q1 2024 format.

National Coworking Supply Grows by Another 7% in Q2, With Even Higher Surges in Indianapolis & Nashville

At the end of Q2, the total number of coworking spaces in the U.S. surpassed 7,000, reaching 7,041—an increase of 444 locations from Q1. This 7% growth follows a 6% increase in Q1, indicating a steady positive evolution in the coworking sector. Leading markets saw significant inventory surges, with Indianapolis growing by 9% to 76 spaces and Nashville by 8% to 90 spaces. Only two of the top 25 markets saw decreases: San Francisco lost one space (now at 120) and Brooklyn lost two (now at 80), but both still maintain a robust coworking supply.

Rates for Virtual Offices & Open Workspaces Remain Stable, Dedicated Desks Go Down in Price

In Q2, coworking prices remained stable overall, with virtual offices holding steady at $119 per month and open workspaces dropping slightly to $149. Dedicated desks saw a moderate decline, decreasing by $9 to a median of $300 per month.

Virtual Offices

Lowest Rates: Washington, D.C. had the lowest rate at $80, while Manhattan and Denver both recorded rates below $100.

Significant Decreases: Seattle saw the largest price drop, down $35 to $154, and Atlanta decreased by $28 to $148.

Highest Rates: New Jersey and Orange County, CA, were the most expensive at $205 and $179, respectively, with Orange County increasing by $20 from Q1.

Open Workspaces

Highest Rates: Manhattan and San Francisco had high monthly medians of $299.

Notable Increases: Dallas-Fort Worth rose to $198 and Houston to $175.

Affordable Markets: New Jersey, Phoenix, and Salt Lake City offered more affordable rates at $119.

Significant Drops: Denver decreased by $26 and Seattle by $24.

Dedicated Desks

Highest Rates: Manhattan led with $520 per month, followed by San Diego and Austin at $400.

Above National Median: Minneapolis-St. Paul saw prices rise to $360.

Most Affordable: Indianapolis had the lowest rate at $209, with Chicago and Raleigh-Durham at $259.

Significant Decreases: Washington, D.C. dropped $25 to $340, and Boston fell by $24 to $375.

Leading Markets by Number of Coworking Spaces: LA Continues to Lead the Nation

In Q2, Los Angeles remained the leader in coworking spaces with 279 locations, marking a 3% increase from Q1. However, Dallas-Fort Worth overtook Manhattan for the second spot, growing its coworking inventory by 5% to 271 spaces, surpassing Manhattan’s 264 spaces, which saw minimal growth with only one new space added.

Washington, D.C. ranked fourth with 258 spaces after a 5% increase. Chicago and Denver followed with 243 and 227 spaces, respectively, both maintaining their previous positions with 3% and 4% growth.

Significant increases in coworking space supply were observed in Indianapolis (9%), Nashville (8%), Philadelphia and Salt Lake City (6% each). Atlanta, New Jersey and Austin also grew by 5%. Boston was the only market with no change, remaining at 202 spaces.

Leading Markets by Square Footage: Nearly 2.9M Square Feet Added to National Inventory as 70% of Top Markets Gain Coworking Ground

Nationally, coworking space square footage increased by 2% in the last quarter, reaching a total of 127,671,340 square feet, which now represents 1.8% of the total U.S. office space.

In Q2, 18 of the top 25 markets saw growth in coworking space. Indianapolis led with a 9% increase to 1.68 million square feet, followed by Brooklyn with an 8% rise to 2.36 million square feet. Dallas-Fort Worth and Salt Lake City each grew by 5%, reaching 5.37 million and 1.68 million square feet, respectively.

Conversely, seven markets experienced declines in coworking space. The Bay Area saw the most significant drop at -11%, though it still has 2.61 million square feet. Other markets like Manhattan and Seattle saw decreases ranging from -0.3% to -5%.

Despite a 5% decrease in coworking space, Manhattan remains the largest market with 11.89 million square feet, nearly double that of Los Angeles, which has 6.5 million square feet. Chicago holds the third position with 6.33 million square feet, surpassing Washington, D.C., now in fourth with 6.18 million square feet.

Majority of Markets Continue to Decrease in Average Space Size, but Brooklyn Gains 10% in Average Square Footage

In Q2, while the total national square footage of coworking spaces continued to grow, the average size of individual coworking spaces declined by 4%, dropping to 18,133 square feet. This trend was observed in 18 of the top 25 markets, reflecting a shift towards smaller coworking spaces even as overall inventory increases.

Manhattan led with the largest average coworking space at 45,023 square feet, despite a 6% decrease. Brooklyn moved up to second place with an average of 29,452 square feet, following a 10% increase, while San Francisco fell to third place with an average of 26,944 square feet, down 4%.

The Bay Area experienced the most significant drop, with the average coworking space size decreasing by 12% to 21,023 square feet. Seattle and Atlanta also saw notable declines of 6% and 5%, respectively. Meanwhile, markets like Indianapolis and New Jersey saw modest increases of 1% in average square footage, indicating a trend towards smaller spaces nationwide.

Conclusion

The coworking sector remains in constant growth. Some of the main factors include the move to integrate a hybrid model and the increase in remote work, which has led many to look for flexible and networking workspaces outside of traditional offices. Coworking spaces foster a sense of community and collaboration, and increased productivity and innovation are great factors in making these office solutions attractive to professionals. With this idea in mind, check out Yardi Kube coworking software to better manage your coworking space and attract clients.